Treis Mining, a Greenville, South Carolina startup, was formed last December with a focus on mining digital currencies. Around $10 million has been invested so far in setting up a digital currency data center. Treis Mining co-founder and managing director, David Pence, says blockchain technology will significantly change various worldwide sectors in the next decade.

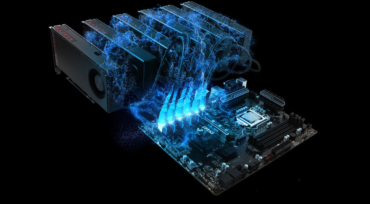

Treis Mining will allocate roughly $8M over two years for the purchase of over 4,000 Application-Specific Integrated Circuits (ASIC) machines. ASIC rigs main purpose is mining virtual currencies. They offer the most effective method of verifying and adding transactions to the blockchain. Currently, Treis Mining has purchased 300 ASIC rigs. They are already running and mining Litecoin (LTC), bitcoin (BTC) as well as other major digital currencies.

Electricity consumption

At full capacity, Treis Mining estimates that the startup will require around 12.5 megawatts of electricity since one ASIC rig consumes around 1,600 watts every hour. The startup estimates that when fully operational. it will become one of the biggest Duke Power customers in South Carolina. Mining one bitcoin in South Carolina consumes electricity worth approximately $4,302. To ensure profitability, Treis will institute several cost-cutting measures including installing a trade chiller of 250 tons. That will prevent the mining rigs from overheating, thus lowering power consumption.

This comes in the wake of the second biggest supplier of ASIC bitcoin mining hardware, Canaan Inc, making July plans of an Initial Public Offering. The IPO expects to raise approximately $2 billion. As the price of Bitcoin rose dramatically towards the end of last year, the profits of the Beijing-based firm increased seven-fold in 2017. In total, they reached a figure of $56.67 million. Most Canaan customers are not retail or individual miners, but rather large-scale miners who own facilities holding thousands of rigs.

Pricing challenges

Pricing is one of the challenges the Canaan IPO is likely to face. There are few firms, if any, to use as comparison. According to experts, the Canaan IPO will depend largely on how the digital currency market fares in upcoming months. Besides Canaan, a smaller rival of the bitcoin-mining giant, Ebang, is also considering a public listing in Hong Kong.